Planting the Seeds of Wealth for Future Generations with Diversified Insurance Portfolios

Planting the Seeds of Wealth for Future Generations with Diversified Insurance Portfolios

As Warren Buffett famously said, "Someone’s sitting in the shade today because someone planted a tree a long time ago." This encapsulates the essence of wealth planning in today’s dynamic financial landscape. Much like planting a variety of trees to yield shade for generations, diversification across solutions and insurers is crucial for safeguarding clients’ financial well-being and ensuring long-term planning success. Reflecting on trends and insights from our recent data, there has been a notable shift towards this strategy in mitigating risks and ensuring the stability of insurance portfolios.

At Howden Private Wealth, we embrace a data-driven approach, leveraging analytics to understand our clients’ evolving needs, anticipate market trends and identify growth opportunities with our business partners based on evidence rather than mere intuition. The data from our portfolio serves as a bedrock for understanding clients’ behaviour, preferences, and risk profiles, enabling us to work with insurers to tailor offerings and deliver exceptional services.

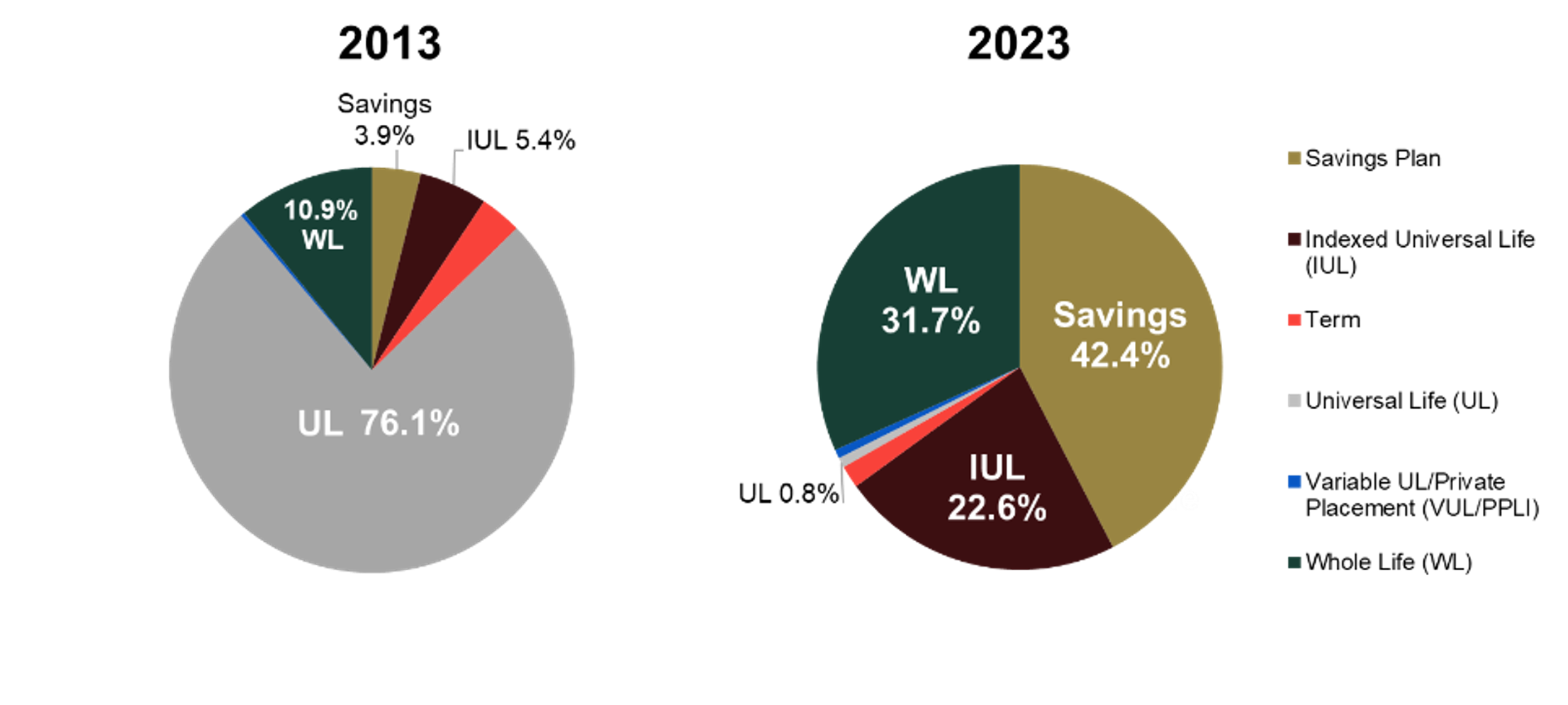

Comparing our portfolio data from 2013 to 2023 reveals a more balanced distribution of various product types, showcasing a diversified allocation of coverage across a range of solutions. Clients increasingly recognise the benefits of spreading their coverage across multiple products and insurers to reduce the concentration of risk associated with reliance on a single product. Evidently, with the market previously dominated by traditional universal life insurance products, recent years have seen a steady rise in the inclusion of whole life, indexed/variable universal life, and saving products.

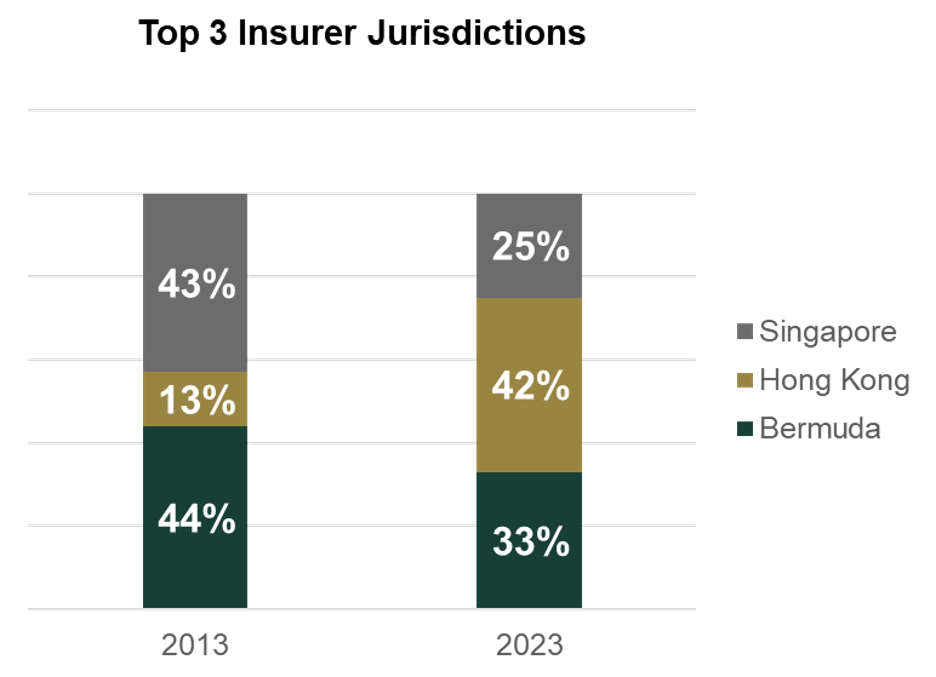

For our globally-connected clients, diversification among insurers is paramount for risk mitigation and portfolio stability. By spreading coverage across multiple insurers and possibly among different jurisdictions, clients can safeguard against geopolitical risks and the potential financial distress or insolvency of any single insurer. In addition to mitigating counterparty risk, diversification among insurers also offers clients access to a broader array of options, features and service experiences. For instance, geopolitical diversification helps mitigate risks associated with regional market fluctuations, regulatory changes and geopolitical uncertainties, thereby enhancing the overall stability and efficacy of insurance portfolios.

Diversification is fundamental to prudent risk management in wealth planning. By spreading coverage across multiple product types and insurers, clients can enhance the resilience and efficacy of their insurance portfolios, ensuing peace of mind for themselves and their families. Our analysis of recent data underscores a clear trend towards further diversification in insurance portfolios in the coming years, as clients seek comprehensive coverage and enhanced financial stability in an increasingly uncertain world.

Debbie Lau

Chief Marketing & Products Officer and Chief Executive Officer, US

dlau@howdengroup.com

An accomplished executive with over 20 years of experience in the financial services industry, Debbie brings a wealth of expertise in High-Net-Worth distribution and multi-channel insurance sales. She has worked with several insurance carriers as well as brokerage and financial planning firms across the US, Hong Kong and Singapore.