Nurturing Prosperity across Generations

Nurturing Prosperity across Generations

The Great Wealth Transfer in the United States has already begun, and it is anticipated that the next generation will benefit from a transfer amount of $84.4 trillion in assets till around 2045. Research however suggests that the following generation will not see an increase but rather a decrease in wealth transfer and that trend is expected to continue.

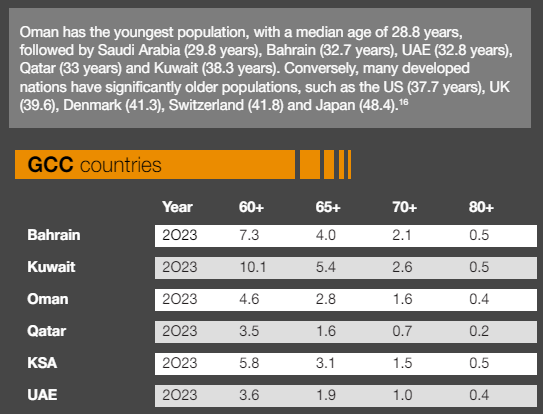

Our business at Howden Private Wealth in EMEA is seeing a different trend in the Middle East and Africa. New wealth is emerging, driven by individuals who are determined to grow for themselves, their next generation and shape the future of their country. The Middle East is also seeing a change in demographic:

Source: PwC

Patriarchs and Matriarchs are passing on the baton and the newer generation have already seen some of the wealth being diluted due to improper planning. They have been exposed to inheritance taxes/estate duty in the US/UK on assets held in those countries, inherited businesses where personal guarantees had been issued or even with huge debts which required to be paid off.

All these have one thing in common, the need for liquidity. When we meet our clients and understand their objectives and identify potential risks to their wealth transfer, we are able to recommend life insurance solutions which can help with transferring some if not all of these risks. Life insurance policies provide sufficient liquidity to pay the taxes due, clear debts and ensure personal guarantees can be addressed via the cash the policy has generated rather than allowing creditors to access the wealth one has created. This is a simple tool, yet so effective.

It doesn’t just stop at the next generation, Patriarchs and Matriarchs are also concerned about the third generation, as they may not be around and perhaps the third generation is going to pursue something beyond the family’s legacy. How does one protect them and provide them with financial stability? The solution is again simple but effective, they buy a policy on the live of their children and name the grandchildren as their beneficiaries. This provides them with peace of mind that they have done their part to protect multi-generations.

We are and want to continue to be part of this story by advising our clients on the importance of wealth transfer, thus ensuring wealth dilution is limited or prevented all together.

Gayatheri Vytheswaran

Chief Executive Officer, EMEA

gvythes@howdengroup.com

A wealth management and insurance professional with over 15 years of experience in the HNW / UHNW life insurance industry, Gaya is responsible for wider Group initiatives with a focus on expanding the company’s footprint in the Middle East and in Europe, developing alternative business ventures and enhancing the platform.